FinTech Magazine’s Top 10 CEOs in Banking

Banking is at the precipice of widespread change as we enter 2024, with digitalisation and modernisation at the forefront of the industry’s agenda.

Today, banks are modernising their infrastructures and launching new fintech capabilities to meet the needs of technology-enabled consumer bases.

Below, we take a look at the Top 10 CEOs leading their respective banks in an increasingly digital banking landscape.

10. James Gorman – Morgan Stanley

Australian-American financier James Gorman has been CEO of Morgan Stanley since 2010. First joining the investment bank in 2006, Gorman was named Co-President in 2007 and took up the role of Chairman in 2012. Beginning his career as an attorney in Melbourne, Gorman went on to assume senior management positions at McKinsey & Co., where he became a Senior Partner, before going on to take executive roles at Merrill Lynch. Since then, Gorman has accrued extensive experience in banking, formerly serving as Director of the Federal Reserve Bank of New York and President of the Federal Advisory Council. Alongside his role at Morgan Stanley, today, Gorman serves as Director of the Council on Foreign Relations and is a member of the Financial Services Forum.

9. Bruce Van Saun – CFG

Bruce Van Saun is Chairman and CEO of Citizens Financial Group (CFG), joining in 2013 after serving as Group Finance Director and executive director on the RBS Board between 2009 and 2013. Van Saun has been an experienced financial leader since 1997, holding several senior positions at leading institutions including Deutsche Bank, Wasserstein Perella Group, Bank of New York Mellon and the Bank of New York. Now leading CFG, Van Saun oversaw the organisation’s IPO in 2014 and led CFG to full independence from RBS in 2015. In addition, Van Saun is currently a Director of Moody’s and sits on the Federal Advisory Council.

8. Ronald O’Hanley – State Street Bank and Trust Company

An MBA graduate from Harvard Business School, O’Hanley is Chairman and CEO of State Street, the US’s second-oldest continually operating bank. Joining State Street in 2015, O’Hanley was first President and CEO of State Street Global Advisors – the bank’s investment management arm – before shifting over to State Street as President and COO. Now CEO, O’Hanley heavily involves himself in investment industry efforts around climate, diversity & inclusion and corporate governance – leading the Sustainable Markets Initiative Task Force for Asset Managers and Asset Owners. He also has leadership roles at the International Business Council, Institute for International Finance and the Council for Inclusive Capital.

7. Robin Vince – Bank of New York Mellon

Robin Vince is President, CEO and Board Member of the Bank of New York Mellon. Vince took the role after holding the position of Vice Chair and CEO of Global Market Infrastructure at the institution, where he led BNY Mellon’s Clearance and Collateral Management, Treasury Services, Markets and Execution Services and Pershing businesses. He joined BNY Mellon after leaving Goldman Sachs in 2020, where he had worked since 1994 and gained a wealth of experience. His leadership roles at Goldman Sachs included Treasurer, Head of Operations, Head of Global Money Markets, COO of the EMEA region and CEO of Goldman Sachs International Bank. Today, Vince is a member of the National Geographic Society's Hubbard Council and serves on the Board of Advisors of The Hospital for Special Surgery.

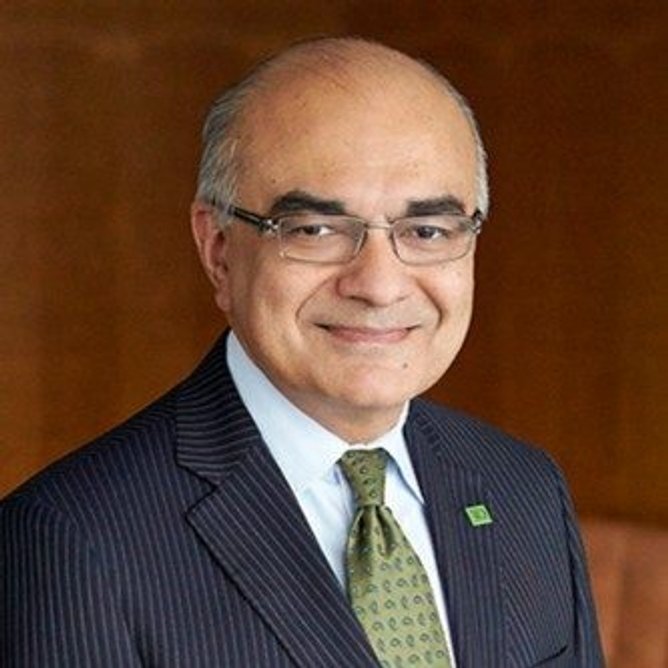

6. Bharat Masrani – TD Bank

Appointed Group President and CEO of TD Bank Group in 2014, Bharat Masrani has over 35 years of executive banking experience, all from within the same organisation. A member of the bank’s Board of Directors too, Masrani previously held the positions of COO and Chief Risk Officer. He was also CEO of TD Waterhouse in Europe, SVP of Corporate Finance and Co-Head in Europe, VP and Country Head for India and Head of Corporate Banking in Canada – not bad for someone who joined TD back in 1987 as a trainee! Masrani has also been the recipient of honorary Doctor of Law degrees from Mount Allison University and the Schulich School of Business.

5. Richard Fairbank – Capital One

Richard Fairbank is the Founder, Chairman and CEO of Fortune 100 company Capital One. Today, he is one of only five founder-CEOs in the US’ top 100 companies. Fairbank has held the position of CEO since Capital One’s IPO in 1994, taking the role of Chairman in 1995. With a former career as a strategy consultant after earning an MBA from Stanford University, Fairbank first conceived the idea to build Capital One in 1987, leaving his career in consulting to build what is today one of the US’ top financial companies. Today, Capital One serves over 100 million customers and is recognised as one of the best 100 places to work. The financial organisation has pioneered data and technology usage in financial services since its inception.

4. David Solomon – Goldman Sachs

David Solomon first joined Goldman Sachs as a Partner in 1999, taking the position of Global Head of the Financing Group where he led the investment bank’s capital markets and derivative products for corporate clients. Then, from 2006 to 2016, Solomon served as Co-Head for Goldman Sachs’ Investment Banking Division before taking the roles of President and COO. Today, Solomon is not only CEO of Goldman Sachs, he also serves as Chairman and sits on its Board of Directors. He is also involved with several philanthropic initiatives as Chairman of the Board of Trustees at Hamilton College and a board member of the Robin Hood Foundation. Solomon also serves on the Board of Trustees for the New York-Presbyterian Hospital.

3. William Rogers – Truist Bank

Rounding out our top 3 is William “Bill” Rogers, CEO of financial services organisation Truist Financial Corporation. The firm is purpose-driven to inspire and build better lives and communities and was formed following the merger of BB&T and SunTrust Banks. Becoming CEO in 2021, Rogers previously served as President and COO between 2019 and 2021. Before that, and before BB&T’s and SunTrust’s merger, Rogers served as Chairman and CEO for SunTrust from 2012. His experience in financial services is extensive, holding senior positions in corporate and commercial banking, retail banking and private wealth management. Embodying Truist’s community-first spirit, Rogers champions the firm’s philanthropy and volunteerism, serving on the board of several national organisations including the Boys & Girls Clubs of America.

2. William Demchak – PNC Bank

PNC Bank is one of the largest diversified financial services companies in the US, and William Demchak sits at the top of the firm as CEO. Joining PNC in 2002 as Chief Financial Officer, Demchak was soon made responsible for the bank’s middle market and large corporate businesses in 2005, as Head of Corporate & Institutional Banking. Then, in 2009, he was promoted to SVP before another promotion just a year later saw him named Head of PNC Businesses. Elected President in 2012, Demchak consolidated his rise at PNC by becoming CEO in April 2012 and Chairman in April 2014. Another keen advocate for cultural and social issues, Demchak serves on the Board of Directors for the Extra Mile Education Foundation and the Pittsburgh Cultural Trust. He is also a member of the Board of Directors for the Bank Policy Institute and of the Business Council.

1. Jane Fraser – Citigroup

At the peak of our list of Top 10 banking CEOs sits Jane Fraser of Citigroup. The world’s most global bank, Citi serves millions of consumers, institutions and businesses across 160 different countries and jurisdictions. Since becoming CEO in 2021, Fraser has launched a multi-year initiative to increase the group’s profitability and better position the bank for the speed and technological complexities of today’s digital age. She is the first female CEO in Citi’s history and is leading the way in transforming the firm’s risk and control environment by modernising infrastructure, investing in culture and driving operational excellence. Today, Fraser has renewed Citi’s commitment to being the preeminent banking partner for firms with cross-border needs, the global leader in wealth management and the most valued personal bank in its home market (the US). Fraser serves on the Board of Directors of the Business Roundtable and the Council on Foreign Relations and is Vice Chair of the Partnership for New York City and for the Financial Services Forum.

**************

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024.

**************

FinTech Magazine is a BizClik brand.

- Hong Kong’s FundPark Lands US$250m in Goldman Sachs BackingVenture Capital

- Sumsub: Identity Fraud up 73%; how can Fintechs React?Fraud & ID Verification

- Money20/20 USA: Convera Talks FX Volatility for BusinessesFinancial Services (FinServ)

- Mastercard: Supporting B2B Healthcare With Payments SolutionFinancial Services (FinServ)