In brief: Pete Cheyne on global payments disruptor Bottlepay

Q. Please introduce yourself.

My name is Pete Cheyne, Founder of Bottlepay. I’ve been in tech for around 20 years now: in 2010, I co-founded Partnerize.com, a global ad-tech platform that had companies like Apple and Google as clients. It was a great journey. After eight years, I decided to make a change and ventured into exploring the potential of blockchain.

Pictured: Pete Cheyne

A year later, I finally saw the evolution of a protocol called the Lightning Network that brought mass market properties to Bitcoin. I’ve always wanted to build something consumer-facing that everyone can use, and then Bottlepay was born.

Q. What is Bottlepay?

Bottlepay is on a mission to revolutionise the way billions of people transact across the world by bringing Bitcoin to the masses. Bottlepay facilitates safe, secure, and social micropayments in a way that benefits businesses and consumers. Our aim is to rewrite the rules when it comes to cross-border transactions, remittances and payments by making them instant and cost effective.

Q. Describe its features.

The Bottlepay platform gives users access to an open payment network that allows people to send, spend, and receive money in real-time without any hidden fees.

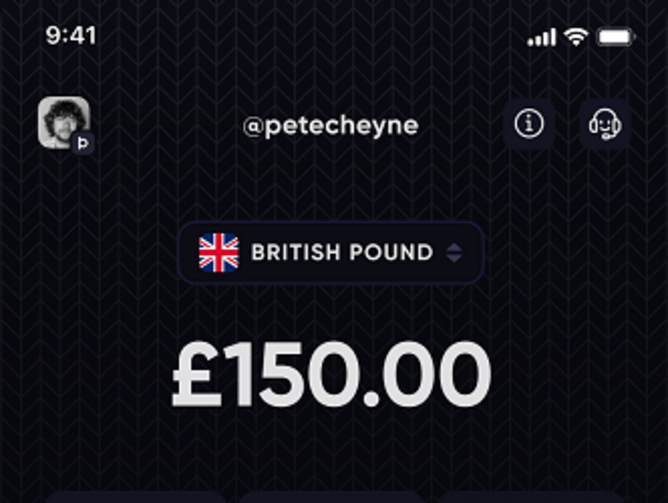

One of the core features of the app is that our users can actually hold a balance in conventional currency (GBP or EUR), and spend that as Bitcoin on demand. There's no conversion process and you can suddenly interact with the new digital payments world without having to learn anything technical.

Pictured: Screenshot of Bottlepay app's home screen

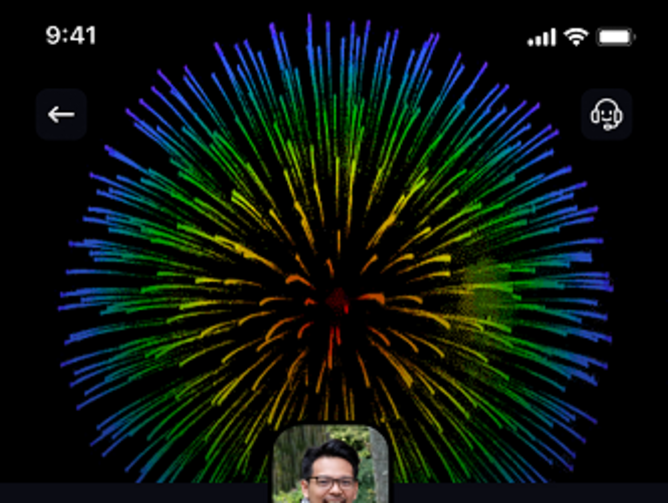

We have added economic integrations into social networks. This enables users to make social payments, currently across Twitter (Twitch, Reddit, and Discord are coming soon), in just one tweet.

On the business side, we are opening up a whole new untapped market. The incumbent payment rails tend to charge a fixed fee (20p to 40p) plus a percentage on top. This makes selling small value items very uneconomical. With our technology, businesses can offer economical transactions for as little as fractions of a penny.

Q. How does it change the game in terms of cross-border transactions?

Cross-border transactions are renowned for being slow and expensive. With Bottlepay, half a billion people across the UK and Europe can now make cost-effective, instant payments to each other within our app, and they can leverage the open network properties of Bitcoin to pay anyone in the world.

When you can send instant cross-border payments, suddenly many legacy payment systems can be disrupted. Just think of remittance payments: these can take up to a week to arrive, have huge percentages of their value taken by the provider, and in most cases have to be collected manually from a brick and mortar store.

We can help make these payments instant, and there will be more of it when it arrives.

Q. Why did you decide to integrate Bitcoin?

You might wonder why we are developing payment infrastructure on top of a volatile asset like Bitcoin. Well, it's actually the Bitcoin network that is the game-changing invention here.

Think of it like the world’s first ever open source monetary system. It provides a level playing field for everyone connected to it, it's revolutionary for financial inclusion. It is to money as the internet has been to the dissemination of information. We want to make it accessible to everyone.

Q. Will other cryptocurrencies be available in the future?

We have no plans to support any other cryptocurrencies, as their associated networks do not facilitate instantly cleared and settled global transactions. However, we are protocol agnostic under the hood for conventional currencies, and will look to support many more in the future (USD, JPY, etc).

Pictured: Example of a Bottlepay payment link

Q. What's your vision for the future of payments?

We are creating a payment infrastructure that can process instant cross-border payments across the globe through an open financial network. It’s a much-needed update on the clunky, outdated payment systems available up until now, and a leap towards better financial inclusion for everyone.